P60

P60 is an end-of-year payroll process that spans over the fiscal year (6 April – 5 April) this document contains the total payroll figures for the year. All employers are responsible for providing a P60 by 31st May following the tax year. This is for employees employed on 5 April.

Why is a P60 Required?

P60 is required for multiple reasons as proof of income, I will outline below some of the circumstances why a P60 may be required:

- Loan application

- Applying for tax credits

- Mortgage application

- Proof of income when renting a property

- Any third-party requirements

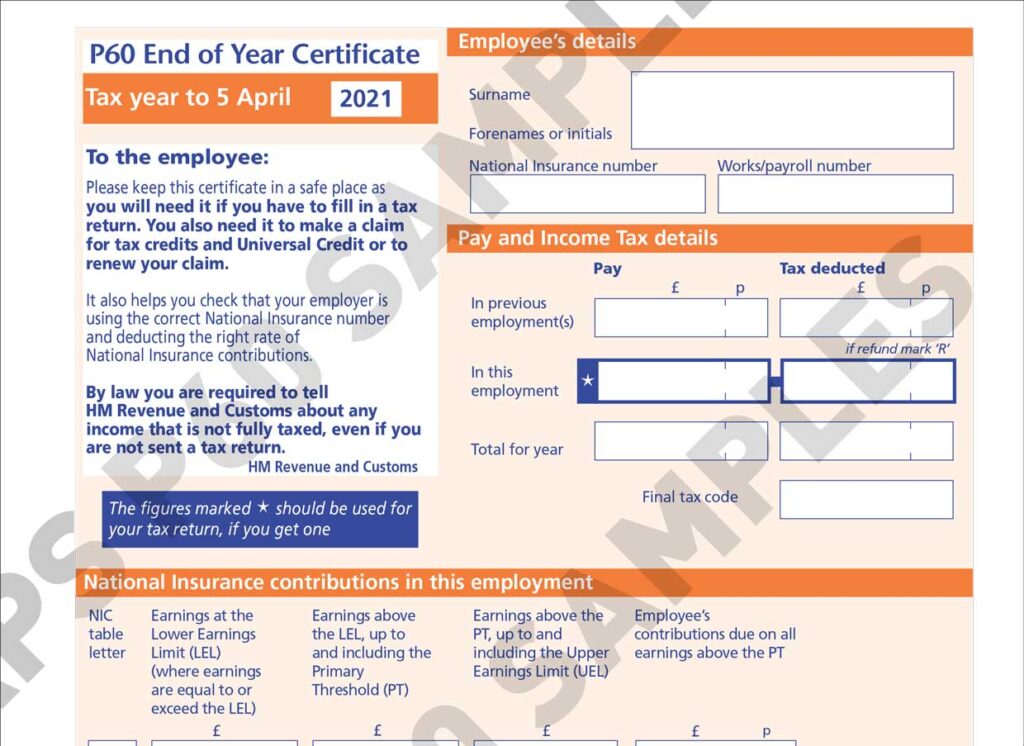

What does a P60 include:

- Name

- National Insurance number

- Tax code

- Worker payroll number

- Pay in the current employment and tax deducted

- Pay in previous employment and tax deducted

- Total pay in the year and total tax deducted

- National Insurance contribution summary

- Statutory payment pay; SMP, SPP, SSPP, SAP

- Student loan deductions

- Postgraduate loan deductions

Why is it important to check a P60?

Many employees neglect to check the details on the P60 as they assume it is correct and don’t consider this document of any importance. There are a couple of reasons why it is important to review your P60:

- Tax code – This explains how much of your personal allowance is used before any income tax and national insurance contributions are deducted.

- Previous employment – If during the tax year, a worker changes employer, it is important employees provide the new employer with a P45. This is to ensure the workers year to date figures are aligned and during the tax year, the correct amount of tax and national insurance is deducted.

If these are not reviewed, you may be in a position where you have over/under paid tax.

FAQ’s

I run my own business, should I receive a P60?

Sole trader & partnership businesses will only provide a P60 to employees that are employed via the business PAYE scheme, proprietors and partners will not receive a P60 as they should not be under the PAYE scheme. This is because their income is derived from their share of net profits. These profits are reported within their self-assessment tax return.

I have 3 employers, should I expect a P60 from each employer?

Yes, employees with multiple employments should receive a P60 from each employer as long as they are employed on 5 April. These multiple P60’s can be used as proof of showing total income for the year.

As a director, my dividends are not reported in my P60?

Directors who are receiving a salary via the PAYE scheme will receive a P60 detailing their salary only. Any form of dividends will be listed in their self-assessment tax return.

I left employment on 31 December; my previous employer has not provided a P60?

P60 is an end-of-year summary, as you have left employment before the fiscal year-end. You should be provided with a P45, this is a statement that provides a summary of year earnings from 6 April – your leave date.